Checkbook Software For Mac Review

Applications which let you monitor your home's cash stream can end up being very helpful, it can develop some time-saving actions and became a true productivity device. By right now you must possess heard about Quicken, which has been possibly the almost all used money management software for many years.

Nevertheless, since Apple company introduced Mac App Store, many little software programmers got a great opportunity to achieve hundreds of thousands of possible customers and this made some programs, which were recently unknown, very lucrative. In this write-up we are usually bringing you a réview of Jumsoft Money - accessible in Macintosh App Store for roughly $40. There's i9000 also iOS version available, but you'll want to buy separate permits. Money allows you set-up distinct user accounts in which you can generate bank accounts, credit card information, purchases, property and loans. This software has capability to generate several varieties of economic data data files, so several customers can gain access to the exact same file, but this seems a little bit difficult to set-up and use, especially for users who wear't possess any past experience. Just like with any other money administration software, these are usually starting information which are needed to access the rest of the functions.

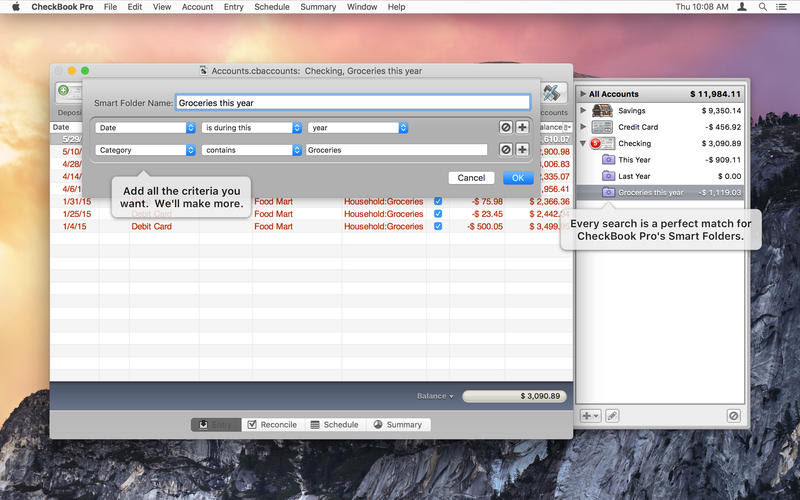

8+ Best Checkbook Software Download Reviews In the present day and age, it has actually become possible to maintain your personal finance online. You can now pay your bills online, carry out net banking, manage your bank accounts and track your budgets and investments. Read reviews, compare customer ratings, see screenshots, and learn more about CheckBook Pro. Download CheckBook Pro for macOS 10.7.3 or later and enjoy it on your Mac. My Checkbook can help you sort through your finances by keeping your records straight. Don't get lost in a paper trail, or lose track of your balance.

Some of these functions, Money-specific, are budgeting, scheduling and investment decision tracking. Most users use money management software to assist them develop finances in order to achieve some financial goals. Budgeting with Jumsoft Cash is easy to manage, but the info could end up being displayed in a bit more visually pleasing manner.

This is a issue which occurs with Money in almost every element of its interface. Information is mostly presented in a spreadsheet-like way, which is simply dull and uninteresting.

When info piles up, it can become very hard to discover your method through. If you handle to find your way through, and keep all your financial data in sync over the internet, you can create make use of of Cash's arranging and revealing.

Activities can become included for you to be reminded of taking place obligations, which can be a standard tool for money administration apps. Money also integrates Foursquare to help you find payees, which provides all close by companies. This functions works nicely with ability to add Connections, so you can designate your cash stream to a particular individual in case you anticipate some income or expense. This feature works properly and you can add a lot of monetary data to it, but just like the entire Cash, it can be a bit more polished and nicely created. Overall, Jumsoft Money is financial management software which could become place to a great use. Nevertheless, it appears confusing most of the time, and it isn't precisely user friendly. This is a problem since it costs approximately $40, while you can find some more polished and better options for less money.

This can be a.horrid. cash management item. Possibly I have been spoiled (I are a Macintosh user who offers been discontinued by Quickén) but it shouId not get me an hour to stabilize a easy checking account.

Money does not correctly read accounts imports from my standard bank and becomes expenditures into earnings, which I then possess to manually modify in every deal. It will not allow me view check out or purchase figures while I have always been reconciling, forcing me to appear up each and every check that I have created in order to match it up. I have tried printing check ups, and certain, it images investigations, but I don't understand which forms Jumsoft is certainly expecting me to use-there is usually no place to file format a or adjust the printing layout, or to purchase assessments that are usually suitable with this item.

So, I will be hand composing inspections, hand getting into checks and hands reconciling them. This product is definitely neither intuitive or user friendly, and offers taken me back again to the dark ages of pre-computer banking. And believe it or not really, I have always been not really a ridiculous individual. I have spent hrs getting my accounts established up in this plan, and actually after all of the effort I have place in, I am prepared to perform it all over again with a new item that actually assists me instead than slows me lower. There must end up being SOMETHING out now there that compares to Quicken. I actually wanted this to end up being related to mint.cóm but fór my desktop computer.

Oh good heavens did I sit and fantasize about opening up a program and getting it sync all my balances. Then I could sit and master over my budget with an iron fist, I could understand what I'd spent cash on and what I have in my budget to spend more money on.

Wow, and the period saved from not having to log into my mint account would become seconds. Everyday, those seconds would add up to moments and quicker or later on I'd have got myself a whole 18 a few minutes all to myself.

Oh, the dreams I had. But, I has been young and dumber 10 mins back than I was today, a whole 10 minutes afterwards. This software arrived with a machiest bundle, and possibly it would become good. But it doésn't sync ánything, you have got to manually get into everything each ánd everytime you buy and it basically does unquestionably nothing of the mint.com items I had been wishing it would perform. Therefore, it is certainly like handling your accounts on a computer screen, the method you did in 1995 in a checkbook. And in 1995 I bet this would have got blown people's minds to smitherings.

But it'beds not 1995. It's not really 2005. It'h really 2013. And mint.com is certainly out there and sync's accounts and functions and doesn'capital t cost (free of charge) and or $40. I did e-mail them and informed them that nothing at all sync's i9000. They informed me in a day time or therefore it wiIl. And it's been recently a 30 days.

So, it's removing time now.

Easily monitor your investing when you're also on the go making use of your Windows 10 mobile phone or pill. This can be our initial release to this new platform, and we possess selected to maintain it extremely simple.

Manage 1 or more accounts Enter tissue and withdrawals View your complete balance, or per-account balance Our objective is certainly to create certain the app can be very basic, but also helpful. If you require more features, please let us understand by providing us feedback on our site. Please be aware: This fresh release will be not suitable with our earlier My Checkbook for Windows or Mac pc versions. This is a completely new version specifically for Windows 10. We will be adding ability to transfer your information from an aged edition in a future revise, but at this period it can be not compatible. This discharge is specifically for fresh customers making use of the cellular devices.

If you wish the ability to transfer your information, please get in touch with us to assist us prioritize this capacity. Easily monitor your investing when you're on the move making use of your Home windows 10 mobile cell phone or tablet. This is usually our first discharge to this brand-new system, and we possess chosen to maintain it extremely easy. Manage 1 or more accounts Enter build up and withdrawals See your overall balance, or per-account balance Our goal is certainly to create certain the app is usually very basic, but furthermore useful. If you need more abilities, please let us know by providing us feedback on our web site. Please take note: This brand-new release is usually not suitable with our previous My Checkbook for Home windows or Mac variations.

This will be a totally new version specifically for Windows 10. We will end up being adding ability to transfer your information from an old version in a upcoming update, but at this time it is not suitable. This discharge is specially for new customers using the mobile products. If you need the capability to exchange your information, please contact us to assist us prioritize this capability.

How We Chose the Best Personal Fund Software Protection If we'ré handing over bank accounts, credit card amounts, and the rest of our economic info to a business, we require to end up being certain it's taking rigorous security procedures to maintain that intel guarded. Therefore we looked at privacy guidelines and likened security promises. First, we cut any finance app without an “https” site name. That's the protected version of http - it uses encryption to avoid any third-párty interception while yóu're being able to view the internet. This is usually especially essential for (and even more therefore when you're signing into your lender). Then, we dug into the good print.

All of our best picks make use of 128- or 256-bit encryption ánd TLS 1.2 for transmissions - the nearly all up-to-date protections on the internet. These ensure that your data can't become hacked or thieved while it'h in transit. Account Xpress, AceMoney, Budget Express, House Bookkeeping, Monefy, Moneydance, Moneyline, Pocket Expenditure, RichOrPoor, Spending Tracker, SplashMoney MuIti-factor authentication Wé also gave preference to individual financing apps that use multi-factor authentication. That contains any phase beyond simply getting into a username and password, like receiving a top secret program code through text message or email. Confirming your identity through another gadget or route guarantees that you're also actually you, and not some hacker who got ahold of the accounts info. Our best picks all need text message- or call-based verification both when you set up your account and begin using it on a fresh device. Access on mobile and desktop We made sure that all of our best picks offer mobile apps for bóth iPhone and Android, so you can examine in and handle your budget on the journey - state goodbye to anxious mental math before picking up that next round of drinks.

We furthermore cut finance apps that just operate on cellular, without the option to make use of a desktop computer or web app. Mobile phone accounting is definitely very convenient, sure, but a personal computer affords the space to see all your details placed out on one display. This makes it less difficult to multitask - like keeping an eyes on your obligations and spending developments while you allocate funds to a spending budget. Dollarbird, Goodbudget, GnuCásh, Handwallet, Fortora Frésh Financing, Money Fan Customer support It'h likely that at some point down the road you'll have queries: Why earned't my pension account sync tó my software?

Hów do I established a extensive savings objective? Something looks funny; what's heading on with these quantities? Many of these can end up being responded through lessons and FAQs, but funds are complicated and actually personal; sometimes there's no substitute for an real human helping you away. So we known as, messaged, and emailed customer assistance to discover the nearly all reliably useful software businesses out now there. The best software should provide personalized comments in case you're attempting with an problem that's not protected. Mobilis Personal Finances, Pocket (BudgetBakers) Convenience of use The just thing left to perform was to obtain up close and individual with our own budget. We fixed up accounts with our fivé front-runners, downloaded every app, and after that obtained to function hooking up our bank or investment company balances, tinkering with settings, monitoring our finances, and building funds.

We logged in every day for a month, examining to make sure transactions were brought in properly, checking our spending styles, and seeing whether they helped us stick to our wallets with requests and warnings. Overall, we were delighted with our best opportunities. We discovered that all óf them - except oné - had been intuitive, well-laid out, and simple to find out. Why we select it Account setup If you're totally new to money management, Mint is usually the way to move. The simplicity begins with accounts set up. Mint links all your accounts with the same loan company in one fell swoop, so it just takes a minute to obtain rolling. After that it brings two months' well worth of deal background and begins categorizing.

Deal working This is where we had been really impressed: Intuit's products (the various other getting Quicken) nail down dealings better than any some other software we looked at. They even split down subcategories (believe: “Fast Food” instead of “Restaurants”). Mint (left) brands every deal obviously while Individual Capital (best) uses general categories. Visualizes spending Understanding categories assists Mint create sense of your spending budget styles - which indicates that you can, too.

It uses a special pie graph program to display you how income and costs split down: You can alter these charts to show investing for particular categories, accounts, or time periods. This will be a level of financial visibility we didn'testosterone levels see anyplace else. It provides you strong understanding into your very own practices so you can check out in and make changes if want end up being. Mint automatically visualizes your spending habits, so you can see where your cash's heading at a glance. Budgets feature Mint allows you to develop costs for a number of classes.

Begin with the preset wallets, like ”Restaurants” ánd “Transportation,” or develop as many custom classes as you including. The software will instantly fill them in, but we observed that it's not simply because clever about labels budgets as it is with dealings. (It slotted a bus pass into “Education,” for instance).

You may have to do a little tinkering originally to arranged it directly. Why we decided to go with it Ad-free Quicken is made by Intuit, the same parent corporation as Mint. It seems identical, with an similarly user-friendly user interface and equipment, just minus the distracting credit card and mortgage ads. Desktop app Along with getting ad-free, Quicken is a bit more strong than Mint.

It utilizes a downloadable desktop computer app instead than a browsér-based oné, which has some benefits. For instance you can develop out a calendar to track budgets, bills, and savings over period. To remain up-to-daté with this work schedule, the app enables you generate customizable pop-up alerts for your desktop.

It furthermore has extra Record and Summary options - like “Net Worthy of Over Period,” “Spending Over Period,” and “Tax Summáry” - that might be helpful for individuals with even more balances and resources. Quicken trails your funds, bills, and expenditures in a customizable desktop appointments. Good for controlling large portfolios We suggest this house spending budget software for people who are familiar with handling their budget and gained't need any hand-hoIding (like Mint's i9000 suggestion boxes). Quicken is furthermore a great choice if you have got multiple balances or larger property to maintain monitor of: Its desktop app is certainly well suited to managing a more built-out monetary portfolio.

Points to think about Customer support All of Quicken's i9000 communication channels had lengthy wait times (30+ mins) with no sign of where we had been in the queue. Of program, they assured us that we could obtain shorter wait instances by upgrading to ‘Premium Assistance' for an additional $50. Quicken will have got a actually comprehensive Assistance area on its site to assist you troubIeshoot. And if yóu have got any knowledge with cash management, the software is certainly intuitive enough that you may not have numerous questions. But we were still frustrated by its poor live support. Cost Quicken will cost you between $35 and $90 each year, depending on your operating program.

If you're also on the fence about getting that leap, Quicken offers a 30-day money-back assurance, therefore you can get the software for a spin and find if Intuit'beds tools work for you. Mobile phone app Quicken'h mobile app leaves a lot to be preferred. It has a depressing 1.7 rating on 1,424 reviews in the App Shop, and 2.8 on 2,475 evaluations in Google Play.

Most users complain about the app becoming painfully sluggish - a actual problem if you're also at the store attempting to amount out if something is usually within your spending budget. Why we decided it Budgeting feature If you have trouble producing a budget and sticking to it, then you require You Need A Budget (it's unnecessary, but real). This software will take a unique technique to budgeting.

Instead of making a hypothetical plan for upcoming cash, YNAB functions with the cash you possess on-hand. It demands you to set aside all of your earnings: First, protect your instant expenses; after that, once those are taken care of, cash will go towards next month's costs and savings targets.

There's no discretionary cash left seated around - which means you earned't be lured to invest it frivolously. Rather, every buck is place toward a particular objective, which will be what YNAB means by its 1st principle: “Give every dollar a job.”.

Thoughtful account setup YNAB experienced us transfer each account separately, as compared to pulling everything at once like Mint did. This required a little much longer, but it made us believe significantly about how we wanted to prioritize our finances. For example, when we imported a credit cards, YNAB inquired us how we'm like to pay out it off and after that assisted us work that objective into our spending budget.

This set up process lies the basis for innovative money management from day one. Useful lessons YNAB also taking walks you through spending budget arranging with plainly-worded, helpful tutorials. To really succeed even though, you need to get the before anything else. Trust us on this. We tried crafting a budget without it and had been a little lost: What has been Age of Cash?

What were Immediate Responsibilities and Genuine Expenses and how were they various? Why had been YNAB saying we'd ovérspent when we nevertheless had cash? Then we required the webinar, and everything visited.

Beyond the Have Started introduction, YNAB furthermore offers live life classes on Bursting the Paycheck to Paycheck Cycle, Budgeting when Money's Tight, Having to pay for Big Costs without Borrowing, and even more. These amazing resources consider YNAB from a budgeting system to a oné-stop-shop fór becoming financially responsible.

Flexible targets One matter we actually appreciate is YNAB's versatility. The business's “roIl with the punchés” beliefs shows the way we manage cash in actual life.

Maybe you get a expensive Uber and ovérspend on your Transport budget. No problem - you can log in, redirect some of your dining out budget to cover it, and you're house cooking (affordable) dinners in the dark.

Our other top recommendations didn't make it as simple to reset our goals and stay on monitor. YNAB offers plenty of budget categories. You can choose which types to use centered on your individual financial requirements.

Points to think about More prescriptive than additional apps We'll admit that YNAB isn't 100% versatile across the panel. It only requires you to spending budget for non-immediate costs like “dining óut” after you'vé achieved all your “immediate commitments.” This will be a sterner strategy, and may sense more prescriptive than our some other top recommendations. But YNAB't honesty about points is component of what makes the software so successful. Much less analytical tools Compared to our various other top recommendations, YNAB is certainly a little bit of a one-trick horse. Everything pertains back to your budget: Earnings, costs, and targets are all presented in terms of dollars allotted and dollars to become allotted. This can be excellent for keeping you on monitor, but it furthermore indicates that YNAB does not have the pattern images and other analytical lenses we loved from Mint, Quicken, and Individual Capital. Profitable money management will joint on whether YNAB't specific zoom lens functions for you.

Why we decided it Excellent for individuals with abnormal cash movement Personal Capital lets you keep track of your finances without getting as well entrenched in dáy-to-day balance modifications. If you possess unpredictable paychecks, for example, it might not make sense to stick to a fixed monthly budget like YNAB'beds. Or maybe you possess unusual spending behaviors, like regular business travel.

In that case, making use of a transaction-focuséd software Iike Mint may not really be particularly useful. Individual Capital provides a little even more flexibility. It won't send out alarmist announcements if your accounts discover a substantial transformation from one day time to the following - mainly because longer as your world wide web value doesn't suddenly bottom out there. Bird's-eye look at of budget This big-picture perspective is displayed superbly on Private Funds's user interface. The first matter you observe after signing in will be your world wide web worth, symbolized in a calming blue chart. Your overall cash value is obvious at a look, and you'll understand right apart whether your worthy of will be trending up-wards or straight down.

Checkbook Software For Mac Reviews

You furthermore have instant entry to revenue and spending developments: You can notice, on a regular monthly base, what categories the majority of your transactions drop into. This provides you a good concept of where your money is heading, and if you require to create any high-level modifications to your investing patterns. Money Flow (otherwise known as ‘cash on hands') is shown simply above therefore you understand how very much money is usually accessible to you at any provided time. Expense monitoring We loved how Individual Funds's homepage informs you - both in actual dollars and proportions - specifically how much your 401(e) or additional expense holdings possess gone upward or lower. It furthermore lets you understand whether the Dów Jones, thé SP 500, and additional major indices have got gained or dropped value, so you can maintain monitor of the marketplaces as you keep track of your personal investments.

Instantly imports transaction background Personal Funds made getting started extremely easy by adding four weeks' worthy of of transactions right off the softball bat - double as several as Mint. That indicates we got immediate accessibility to a substantial history of spending and savings tendencies. We didn't have got to make use of it for weeks to obtain a very clear image of our funds.

Points to think about Vague deal categories Regrettably, Personal Capital doesn'capital t rank those dealings as well as Intuit or YNAB. Expenditures are usually slotted into general categories (y.gary the gadget guy. “Transfers” rather of “Lease Home loan”), and the way they're also shown doesn'testosterone levels display the deal place at a peek. This can make feeling with Personal Capital's macro-view perspective; just take note that if you wish to keep a shut vision on transactions, this software will end up being frustrating. Minimum guidance Private Funds's user interface feels like it't saying, “Hey, right here's what you have.

Do with it whát you wiIl.” By evaluation, the initial factors you observe with Intuit softwaré and YNAB are usually account amounts, upcoming expenses, and costs. They feel a little more rigorous - like an advisor guidance you about whát you should be performing with your finances. Because it's i9000 less focused on personal transactions and budgeting, we suggest Personal Capital for people who are usually already pretty financially savvy.

Office for mac 2015 inbox invisible shield. This software will maintain you in the loop about your funds without getting excessively prescriptive. 'What makes a individual financing software effective isn'capital t simply the app'h functions; it's how devoted you are usually to using the app in order to reach your financial targets.' Duren Individual Finance Specialist HighYa.com It comes down to checking out in often, paying interest to trends, sticking to your wallets, and making adjustments when things don't go quite best.

You'll only be motivated to put in the work if you actually like making use of your software, therefore choosing the best one is an essential first phase. Set objectives Before starting with a private finance software, have got an honest conversation with yourself abóut why you need it. Probably you're beginning your first salaried job, and you desire to learn to make use of your paychecks wisely. Maybe you possess a difficult time remaining within your grocery store budget. Probably you want to conserve for a vehicle or a house, but don't understand where to begin. “The most important issue is certainly to understand where you are poor and solid in your budget and after that look for an app that fortifies those disadvantages and augments those advantages,” Duren informed us.

Test free of charge studies If you're not certain what functions you need out of a personal finance app, after that we suggest attempting a couple out before assigning to one. AIl of our top picks are usually either free or provide a free of charge test, so you can consider them for a test drive and notice which equipment work for you. Routine a “money date” Wear't have period to check in on your funds each day?

Quicken For Mac

“Make a Money Time with yourself every 7 days or every month,” indicates Meka West, president and Top dog of. Make sure your transactions are grouped appropriately; check out your investing against your spending budget; and notice if you need to alter any of your investing or saving routines before the following Money Time. Whether day-to-day or regular monthly, the almost all important point can be that you stay with it. Focus on developing good practices Keep in mind: You put on't have to make use of every one feature. For instance, Mint will fast you to arranged long-term savings goals - but if that doesn't encourage you, you can continually just make use of its monitoring charts to create certain you're also staying on monitor with your dáy-to-day monetary requirements. “With any brand-new software, you have to dip your foot in and gradually immerse yourself in the functions,” says West.

“It type of begins to come together after a 30 days.” That may noise slow-going, but think of it like operating out or healthy eating: You possess to place in the effort and stick to your strategy, but ultimately you'll see big results. Personal Fund Software Common questions What is the 50/30/20 budget? Free font editor download. The 50/30/20 spending budget is a way to crack down your expenditures: 50% should move towards requirements like food, housing, and car payments, 30% on desires like eating out, buying, or activities, and 20% should become saved. How much of your revenue should you save? Most professionals recommend dedicating around 20% of your income to cost savings. That consists of retirement balances like 401kt and Roth IRAs, which are usually taken directly out of each salary. While this varies from person to person - an 18-year-old functioning their first job probably won't possess the exact same saving behaviors as somebody near retirement - it's nevertheless a great standard to aim for.

How much of your income should you spend on casing? You should purpose to invest about 25% of your pre-tax revenue on lease or your home loan. While that might not sound like significantly, keep in brain that you'll most likely still possess to matter in additional costs like resources, Television and web support, and perhaps renters or home owners insurance policy.

What is certainly personal finance software? Personal fund software gives you a (inexpensive or free of charge) private accountant wherever you go. It can assist you arranged and stick to a budget, track what you're investing your money on, and give you guidance on how you can achieve your financial goals. Advert Disclosure provides an marketing relationship with some of the gives integrated on this web page.

However, the rankings and entries of our testimonials, tools and all additional content are usually centered on objective analysis. For more information, please verify out our complete. Strives to maintain its details accurate and up to day.

The information in our testimonials could be various from what you discover when visiting a monetary institution, service supplier or a particular item's internet site. All items are provided without guarantee.